Table Of Content

Although buying allows you to have more freedom with what you do with your home, with more power comes more responsibility. The decision to buy a home isn’t only about finances, and owning isn’t right for everyone who can afford it. Finances matter, of course, but so do your future plans, lifestyle, location and other factors. Answer a few questions to learn what may be best for you.

If You’re Preparing to Move, Should You Buy or Rent?

If you like the area where you live, are generally ready to settle for at least three to five years, put down roots, and keep the same job, being a homeowner may be a good fit for you. You bear the cost of maintaining the home you own. This could include anything from replacing a roof, buying a new water heater, and repairing a damaged driveway. If something breaks down, as the homeowner you have to fix it.

Columbia University is at the center of a growing showdown over the war in Gaza and the limits of free speech.

However, timing the housing market could be difficult, because we just don’t know what will happen. Whether it’s better to rent or buy a home depends on your personal finance circumstances. To answer this question, you should consider several factors, like your budget, your lifestyle and where you live. We’ll break down the pros and cons of both renting and buying to help you decide what’s best.

Los Angeles utility prices

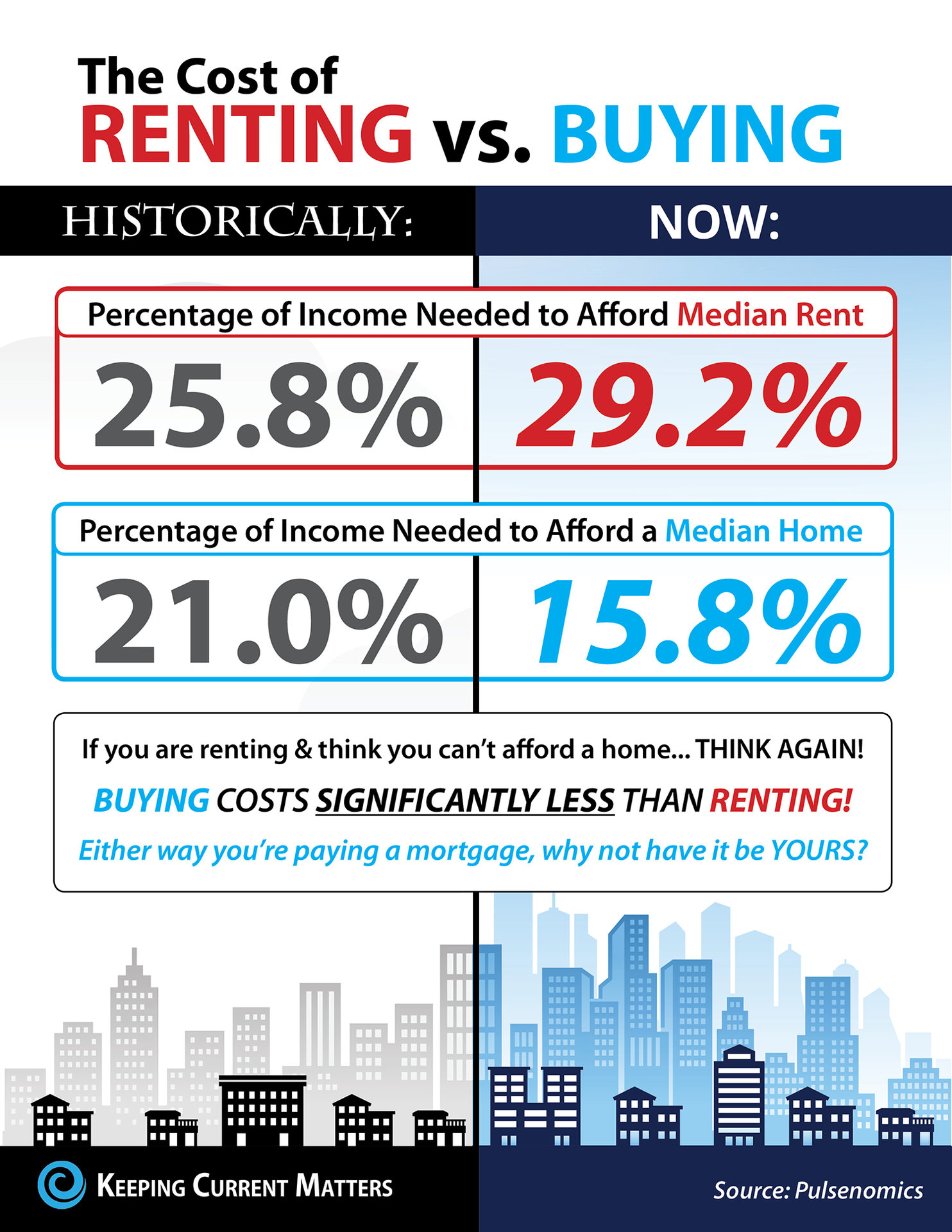

The table below shows how much money you need for either scenario. For example, if you buy, you will need a $60,000 down payment and $12,000 in closing costs upfront. Renters don’t pay closing costs but they do pay a deposit typically one or two month’s rent. Inflation impacts the cost of rent as well as interest rates when taking out a mortgage, sometimes one more than the other. A closer look at the renting vs buying question reveals just how complicated this decision can be. Buying a home affords more lifestyle stability while renting gives the flexibility not to be tied to one location.

For many apartment residents, homeownership isn’t part of the American dream. The survey found 41% of renters say it has nothing to do with homeownership. They’re increasingly expecting to rent for the long haul as they invest in other areas to build their quality of life.

Top 10 Metros Where It's Cheaper to Rent a Home Than Buy - Kiplinger's Personal Finance

Top 10 Metros Where It's Cheaper to Rent a Home Than Buy.

Posted: Tue, 26 Sep 2023 07:00:00 GMT [source]

Nashville Housing Market in 2024: What You Need to Know

The same applies to everything from interest rates to flood insurance to cost of construction. Examine availability, prices, interest rates, even housing regulations where you live. If everything checks out and you are otherwise ready to buy, go for it. The table does not consider losses or gains you might realize by, for example, renting instead of buying and investing the $72,000 down payment and closing costs in the stock market. Some retirees do that when they sell their home in order to downsize.

For instance, it's better to rent if you don't have plans to stay in an area for a long time. I have a nest egg, with savings in the bank and enough money to cover a down payment. If you’re looking to put down roots, buying a home is a great way to make yourself part of a community. But if you’re not ready to settle down, remember that once you sign on the dotted line, picking up and moving will be harder.

Renting vs. buying a house

Most people have to pay for shelter — it's just part of being a modern American. Tenure, finances, location, housing availability, interest rates, job security, and so much more are all a part of the decision-making process. The one thing you shouldn’t do is rush into anything, especially buying since it is a much more complicated process. The decision to rent or buy is far from a simple matter of which is less expensive.

Cons of buying a house

This can be particularly reassuring if your job or lifestyle could change in the near future. I want to repeat that renting is not a waste of money. And as long as you’re paying for a place to live, your money is well spent. To figure out the cost of renting, search online for rentals in the neighborhood where you want to live. Rental listings should give you an idea of the cost of rent, plus utilities and other fees.

On the other hand, if you've found a community where you'd like to put down roots, buying may be the better option. Owning a home offers more stability and potentially more financial benefits for homebuyers who plan to live in an area for more than just a few years. Entrata compiled the report using an online survey prepared by Method Research and distributed by PureSpectrum among 2,000 U.S. renters in large 50-plus unit apartment communities from Jan. 3-12.

The virtues of buying grow when you stay in a home for a while. As the years pass and your home’s equity and value have a chance to build, less of each mortgage payment is used to pay off interest and more goes toward your principal. Are you deciding between renting or buying a house? Maybe you’re ready to move out of your rental and into your own home. Or perhaps you’re relocating to a new city and contemplating whether to rent a home before making the leap to homeownership. Whatever your reasons, take a moment to consider how renting vs. buying a home will affect your life now and in the future.

Buying a home is a huge decision, and picking the right mortgage is a huge part of that process! Here's why the 15-year fixed-rate mortgage might be one of your best options when it comes to buying a house. Before you buy a home, you need to make sure your financial house is in order. Next, save an emergency fund of 3–6 months of expenses, and after that, start saving for a down payment. Whether you’re ready to buy or want to keep renting, you’ve got a better idea of what you’ll be getting yourself into.

Renting takes a little bit of that responsibility off your plate. As a renter, you’re not required to make a huge down payment, although you may have to put down a security deposit. You also don’t have to worry about property taxes or the cost of maintenance and repairs.

The best mortgage lenders and experienced real estate professionals can help you analyze your options in this volatile market. For instance, you can negotiate seller concessions, like an interest rate buydown, a home warranty or help with closing costs. There are still smart ways to become a homeowner in today’s economic conditions, but it will require some creativity and adjustments to your expectations. Adjustable-rate mortgages, also known as ARMs, have fluctuating interest rates. Property taxes can cost homeowners hundreds or thousands of dollars a month.

Renters insurance is less expensive than homeowners insurance because it only covers the cost of your personal property, not the building where you reside. It also includes personal liability insurance in the event someone is injured on the property and it is your fault. You are not responsible for maintaining your house or apartment when it comes to replacing owner-provided appliances, fixing plumbing issues, painting, or remodeling.

Upfront costs are the costs you'll need to pay before moving into your new home, including your down payment, closing costs, and other fees. Your rent payment is the money you pay to your landlord each month. Home location helps accurately estimate today’s interest rate, tax rate, home insurance cost, and the average home price. Understanding the benefits and drawbacks of each option will help you analyze your choices and settle on the one that makes sense for you.

No comments:

Post a Comment